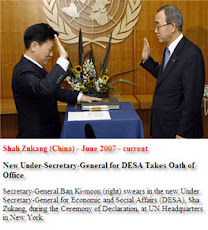

Meanwhile, certain individuals whom in recent years worked in DESA under long-term SSAs have been avoiding taxes in their countries with claims that they are "UN staffers" while their position in the UN was only a consultant ("long-term consultant"). Despite the fact that an SSA is consider an "independent contractor" and thus is entitled to pay all income taxes in their countries. Sources say at least 700 cases are under review.

Also in the eyes of the investigators are certain staffers who lied about their current nationality in order to avoid loosing their job and have used their "second" nationality(s) as a cover up.

All these is happening at the UN's flagship department which is currently advising world leaders and countries in matters such are transparency and accountability.

WHAT A SHAME !

14 comments:

Abolish the U.N. What has it done to create world peace and tolerance? It seems that this nefarious organization gets more corrupt by the year. Not all but a lot of people within the U.N. have entitlement mentality and they don't/won't disclose financials. Is it any wonder that they create lies for tax evasion.

This is major loophole that the United States, mostly Democrats have "forgotten" in order to allow their fellow Socialist and Communists whom are hired on regular basis from the UN mainly on "Special Service Agreements - SSA" or "Service Contracts - SC" both for durations which go from 11 months to some time extended for years.

You should rest assured that if the U.S. IRS would start applying the regular tax of 30% flat on incomes generated while in US soil from these consultants, none of the above corrupt socialist and communist fellows will opt to come to US.

The remuneration of either SSA or SC is established on the basis of the level of the tasks to be

performed and on the degree of qualification and experience of the consultant.

The amount of the gross remuneration is based on the prevailing salary rates for similar functions or, as

applicable, on the UN system General Service or Professional Officers scales. The remuneration is expressed as an all-inclusive lump sum payable in local currency of the place where the consultancy takes place.

Considering that in United States the UN Secretariat and Funds and programmes hire approx. 25000 consultants (short term) every year, and considering an average $500 per day per each of these, than the potential Taxable Income that is escaping US IRS is close to $1 Billion dollars of potential taxable income that should have been declared and payed from UN consultants while performing services in US Soil.

No separate benefits or allowances are payable.

Time has come for the US to get out of United Nations. Send them to London let em pay for them for once

Any income that a non-resident or resident in the territory of the US is subject to taxation. If this loophole exists should be terminated and the administration should have the courage to stop this corrupt individuals from escaping both US tax system but also their own native countries.

is somehow understandable for those who are real staffers of UN meaning diplomats, because maybe they fall under some international treaties. but for those who are simple consultants and non-staffers and earn all this money? this is out of mind and seem to me that is created for a pool of "individuals" who stay under the radar and are not reported neither into US or their countries tax authorities. meaning a complete shadow area where "illegal deals" take place and why not many UN official can hire their family of be able to 're-direct" money for other purposes.

just throw em out!

if US and Obama are serious about UN reform they should:

1. stop all non-core payments to UN;

2. demand full disclosure of accounts on yearly or even six-month basis;

3. stop issuing G4 visas for every one who come at the UN and diversify STAFFERS from CONSULTANTS;

4. force all non-UN-staffers to pay taxes for income earned while in US soil;

having worked for the UNICEF I can attest that many consultants (foreign nationalities) come to US and provide services for very short periods even without US G4 visas. Many of these are Europeans or from nations whom are not required an US entry visa and whom can stay up to 90 days in US territory.

I agree that both SSA and SC does not exempt anyone form paying taxes in any country where they perform services. This "false entitlement" created from UN has to stop because many countries, not only US, but also Switzerland, Austria, italy, Kenya as well as places where UN has regional offices like Thailand or Panama could earn quite a lot from taxing Income from these "fake UN employees".

this is very simple if UN Secretariat salaries in three countries: United States + Switzerland + Austria are approximately $6 billion a year and calculating that 25% or this income goes for consultants (non-UN-staffers) the potential tax evasion across three countries is=

$6 billion x 0.25 = $1.25 Billion of Gross Income

of which if we consider a flat 30% Tax code (in Switzerland and Austria is much higher)

the potential TAX income is $450 Million per year only in these three countries.

I believe one has to be in the US for more than 180 days a year to be liable to pay taxes. So, unless a consultant is engaged for more than 180 days in a year, we cannot tax him/her.

you are right - unless a person is engaged for more than 180 days a year he/she should pay taxes. But why are you not quoting IRS rule to the end, which says unless you work 180 days or maximim $3500 dollars. Anything above $3500 dollars should be taxes irrespective of 180 days mark. therefore all UN consultants should pay tax in the country where they perform their services.

The moment the IRS and US Treasury would enforce this rule, the United Nations Non-Core expenditures will go down by 80-90%, because no consultant, former socialist or communist around the world would be crazy enough to come and pay taxes. They are used of not paying income taxes and want all free of charge.

Why is US Mission to the UN (USUN) and its Host Country Committee being so passive in enforcing US immigration and taxation policies?

Why is USUN not asking for detail name, last name, nationality, purpose of contract/service, duration - and provide accordingly the right VISAS for those who come as consultants in the US soil to provide independent contractual services to UN.

At the moment an individual is an independent contractor even for the UN, he/she cannot claim UN immunity because as per their contracts they do not perform STAFF FUNCTIONS nor they can represent or speak on behalf of the organization, nor they pay any STAFF ASSESSMENTS as every other UN staffers.

Therefore this loophole is created intentionally by certain politicians either in the US but definitely inside the UN as well who wants to allow their fellow International Socialists to come and have an extra undeclared income at the UN.

In UNDESA thee are at least 100 short term staffers who have been issued UNLPs and long term UNIDs who do not correspond to their contractual status. All their paperwork is different from what DESA produces for DSS and Travel Unit.

at DC1-11th floor many DESA files have been shredded and no longer be found.

Post a Comment